Consumer Advocate's Homeowners Insurance Review Review

- By Captain DIY

- •

- 12 Jun, 2019

- •

As Reviewed by Captain DIY

Disclaimer: I am not getting monetary compensation to write this review, and the findings of said review are those of the authors of said review and not mine. Seriously, I don’t know anywhere near enough to have actual opinions about insurance, I’m just bumbling along without a clue, which is why I read things by people who are much smarter than me.

I like to show folks like you how to do things around the house so that you can avoid spending your paycheck on Handyman Harry whenever possible. For example, I showed you how to hang up window blinds, how to fix a squeaky floor

(as written by my friend Mr. Burrito Bowl), and even how to make your very own dumbbell handles for super cheap!

As DIYers, the world of insurance is something we need to be familiar with, and it can be a huge scary one. I recently changed my homeowner’s insurance carrier in an effort to reduce my monthly expenses, and I feel like I did ok, but I really didn’t know what I was doing when I was shopping. Nothing like fumbling around in the dark for protection of your most valuable physical assets, eh?

Have No Fear, Somebody Smart is Here (Not Me!)

I recently got an email from a group called Consumers Advocate, in which they were hoping I could look into and share a research project they did. Lo and behold, this project happened to be about homeowner’s insurance, the very beast I had just attempted to tackle! Of course, it’s too late for me this year, but I thought it looked like something that would prove itself useful to a lot of you out there, so I dove in.

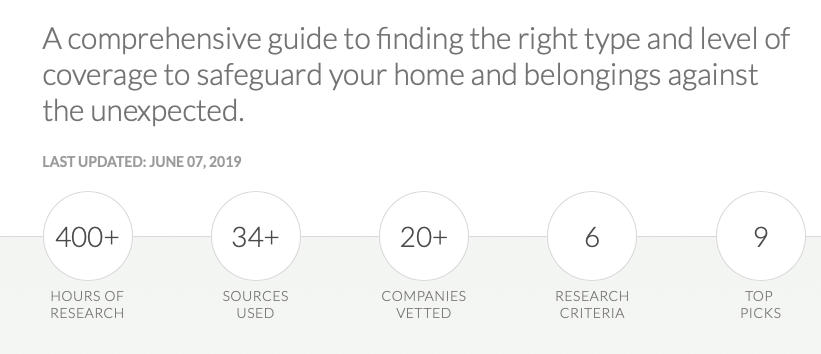

The research project these smart folks came up with is called Best Homeowners Insurance Based On In-Depth Reviews, which is an incredibly droll and scientific title for a fantastic dearth of super useful information. In other words, they are bona fide scientists (I think).

Let’s Break it Down

Here’s what they came up with in a nutshell: a comprehensive list of different homeowner’s insurance carriers broken down into user-friendly categories such as Best For Quick Quotes, Best For First-Time How Buyers, Best For Customer Service, etc. They start off by describing how they came to these ratings conclusions using different analysis points, and then proceed to go into great detail on each carrier and why they placed it in a particular category.

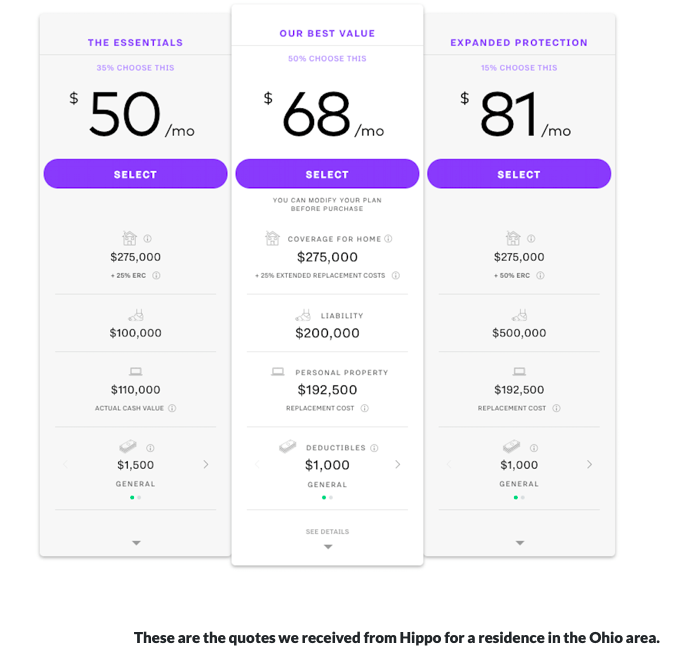

A quick example, and I don’t want to go too deep here, is a review on Hippo, which is in the Best For Quick Quotes category. They start by giving a brief background on the company and their claim to fame, and then go into the dirty about their own experience getting a quote.

This is followed by some more technical details about the way the company operates and who is backing them up, along with a Researcher’s Rating and link to a Full Review. The nice thing about heading off to that full review, in my opinion (as is everything on this blog), is the opportunity to read some reviews and comments from people who have had experiences with that particular company.

The Good, The Bad and, Well, It’s About Insurance, So What More Do You Want?

One of the things I really appreciated about this project was the way they designed the page. It’s huge, and there is a ton going on, but they make it really easy to find a particular search arena and check that out. For example, there is a table at the top with the Best Of categories and links to each company’s website. Next to that is the table of contents with links that send you directly to the part of the page you want to read, so you don’t have to scroll through miles of other crap you aren’t interested in. Seriously, it’s a huge page, and my scrolling fingers were getting tired. No, I’m not getting soft, stop it!

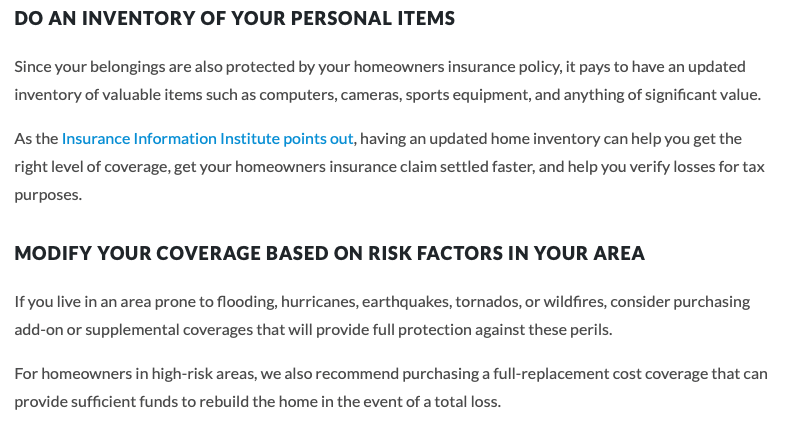

Another thing I found helpful was the FAQS About Homeowner’s Insurance section, in which they tackle questions like, “Do I need home insurance for my tiny home,” and “What’s included in a standard homeowners insurance policy?” If you are someone who doesn’t know a whole lot about homeownership and insurance and how they interact (me), this website seems like a great place to start. Come May of next year, I will definitely be digging through this some more before I buy my next policy.

Which brings up another great point: when I first checked out the site, it had been updated in May. When I went on again in preparation of this article, it stated that it had been updated in June, which leads me to believe they are continually researching and updating this database.

In other words, this is not a one-and-done type of thing, just as buying insurance is not a set-it-and-forget-it type of thing. Keep coming back to this, and make sure you aren’t getting hosed by being on autopilot. Seriously, it’s only once a year.As far as the bad goes, the only complaint I could muster was that the customer reviews for each company all seem to suck. It would seem that not many people are happy with their insurance companies (gasp!). You heard it here first folks, the secret is now out!

Let’s Wrap This Up

I want to point out very clearly here that I am not getting monetary compensation for this review. They asked me to review their product, I asked them for money, they said no, I said fine, they said they thought I was really cool and definitely the most handsome blogger out there (I mean, not in so many words, but it was between the lines), and I caved.

I’m writing this because I really do think this is a helpful tool that can shine a bit of light into the murky depths of insurance coverage, and until this kind of stuff is taught in high school (come on people, why do I know what an isosceles triangle is but I know nothing about how much a trampoline adds to my insurance premium) we desperately need resources like this to get through life without getting fleeced.

So, to finally wrap up this review of a review of reviews, let me just say that the team at Consumers Advocate have done a tremendous job with this project, and it should be required reading before any homeowner’s insurance purchase.

At the very least, you won’t be limited to the companies that advertise on TV.

The aforementioned research project, along with a whole lot of other useful articles, can be found at consumersadvocate.org.

Stop by their site and let them know the Captain sent you!